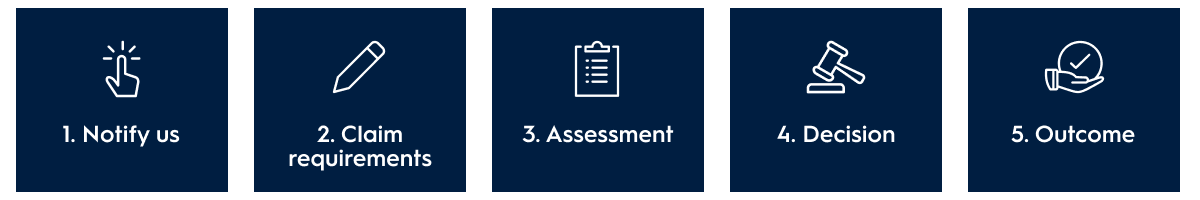

Supporting you through your claim

Below is a breakdown of how to make a death benefit claim and what the process is once your claim is lodged.

What is death cover?

Also known as life cover, death cover gives your beneficiaries or estate a lump sum payment when you pass away. We pay this cover in addition to your super account balance. To make sure your super, and any life cover, goes where you’d like it to, you need to have a valid beneficiary nomination. If you don’t nominate a beneficiary, your super fund may have the discretion to choose who gets the payment, regardless of what you have in your will.

To learn more, visit nominate a beneficiary.

Who can receive a death benefit payment?

When a member passes away, generally we can only pay a super death benefit to dependants and/or a legal personal representative. The legal personal representative is the executor or administrator of the deceased’s estate.

If we can’t locate a legal personal representative or a dependant, only then can we consider paying the benefit to another person. There are laws around who is considered a dependant or eligible beneficiary. A beneficiary must be a dependant under superannuation law, and/or your legal personal representative.

You can nominate:

- your spouse (including de facto spouse or a same sex partner)

- your child (including an adopted child, stepchild, the child of the member’s spouse or an ex-nuptial child)

- any person who was wholly or partially financially dependent on you at the date of your death or any person who is, or was at the relevant time, in the opinion of the Trustee in an interdependency relationship with the member (generally a close personal relationship between two people who live together, where one or both provided the other with financial support, domestic support and personal support), or

- your legal personal representative.

If any beneficiary nominated is not a dependent at the date of your death, the nomination will be invalid.

To learn more, visit nominate a beneficiary.

Notify us

There are three ways you can start the claims process.

You can call, email or write to us.

Call: 1800 667 841, Monday to Friday 8:30am and 7pm (Sydney time)

Email: north_claims@amp.com.au

Mail: GPO Box 2915, Melbourne, VIC 3001

To begin, you’ll to have the late members:

- first name, middle name and last name

- their North client reference number, if known

- date of birth

- date of death

We need this information so we can make sure we are referring to the right person. We’ll also need your contact details including name, email, phone number and postal address.

Claims requirements

Once we have been notified, we’ll send you a claims pack to fill out and return to us by email or post. We’ll only ask you for the information that we need to start your claim.

You will be assigned a dedicated claims case manager. Your claims case manager will be your point of contact throughout the claims process.

Assessment

When we get your completed paperwork, we’ll check to make sure we have everything we need. If there is something missing or incomplete, we’ll let you know.

If there is insurance as part of your claim, we’ll pass your claim to the insurer within 5 business days for assessment.

Your claims case manager will keep you informed about the progress of your claim. You'll get progress updates at least every 20 business days.

If you contact us with any questions about your claim, we’ll get back as soon as possible, but within a maximum of 10 business days.

Decision

We’ll confirm who will be paid the death benefit payment.

Who gets the death benefit payment depends on if the late member had a valid beneficiary nomination, or not. The death benefit payment amount includes the insurance component (if any) and the super balance.

If there’s a valid binding or non-lapsing nomination, we are bound by superannuation law to pay the nominated beneficiary.

If there’s no beneficiary nomination, we’ll follow the relevant fund rules and pay the death benefit payment to your estate. If we cannot pay your estate, we may use our discretion to determine the beneficiaries.

If there are several potential beneficiaries, we need to go through a process known as ‘claim staking’.

During claim staking, we’ll generally tell potential beneficiaries how we intend to pay the death benefit. Potential beneficiaries have 28 days to lodge an objection, if they don't agree with us. If we get an objection, we can’t pay the death benefit payment until we resolve the objection.

Outcome

Where there’s no objection to our proposed death benefit payment decision, we’ll ask you to provide:

- Payment instructions.

- A completed Know Your Customer form, which we’ll give to you to fill out.

- Certified proof of identity from the relevant beneficiaries.

The total death benefit payable will include the late member’s super account balance plus any insured benefit (if the member held insurance and the insurer approved the claim).

How long will the process take?

Timeframes can vary for an end-to-end death benefit claim process based on:

- How long it takes for the forms to come back and if we require additional information.

- If we need to identify potential beneficiaries.

- The investments that are required to be sold down.

- If there is a life insurance attached to the policy and the time taken by insurer to complete the insurance claim.

For death benefit claims that are simple (i.e., have a valid binding or non-lapsing beneficiary nomination), providing we have all the information we need, the process may take up to 3 months.

More complex claims can take up to (but typically no longer than) 6 months after the death certificate is received.

Learn more about how to make a death benefit claim.

Support when communicating with us

If you prefer to speak to us in another language, contact the Translating and Interpreting Service on 131 450.

If you find it hard to hear or speak on the phone, the National Relay Service (NRS) can help you to call us. For more details visit accesshub.gov.au.

When the NRS helps you to communicate with us, they’ll need the phone number you want them to call. You can find a list of phone numbers above.

If you’re a First Nations Person, we’re committed to giving you culturally appropriate support. Please contact us as there may be alternative options available for your identification requirements.

We're here to help

North Service Centre

Monday to Friday

8.30am - 7pm (Sydney time)

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your personal objectives, financial situation or needs, and you should consider whether this information is appropriate for you before making any decisions. It’s important you consider your circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for you.

Any tax and social security information is based on NMMT’s current understanding of the applicable legislation. Any tax information provided is not considered to be personal tax advice and cannot be relied on as such. Whilst all effort has been made to ensure the accuracy of the information supplied, NMMT and its related parties are not responsible for any errors or omissions and do not accept liability for loss or damage to the reader or any other person.

MyNorth and North Super and Pension are issued by N. M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N. M. Super) as trustee of the Wealth Personal Superannuation and Pension Fund ABN 92 381 911 598. NMMT is a service provider to NM Super of administration and other services.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N. M. Super and their representatives may receive in relation to products and services provided. You can also ask us for a hard copy.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.