Reduce the cost of implementing advice with our simple online processes and features.

Prepare advice easily with modelling and compliance tools that are seamlessly integrated with our platform.

Run your business smarter with our practice reporting and workflow management tools.

Digital experiences and customisable reporting that put you in control and help showcase your advice.

A snapshot of our features

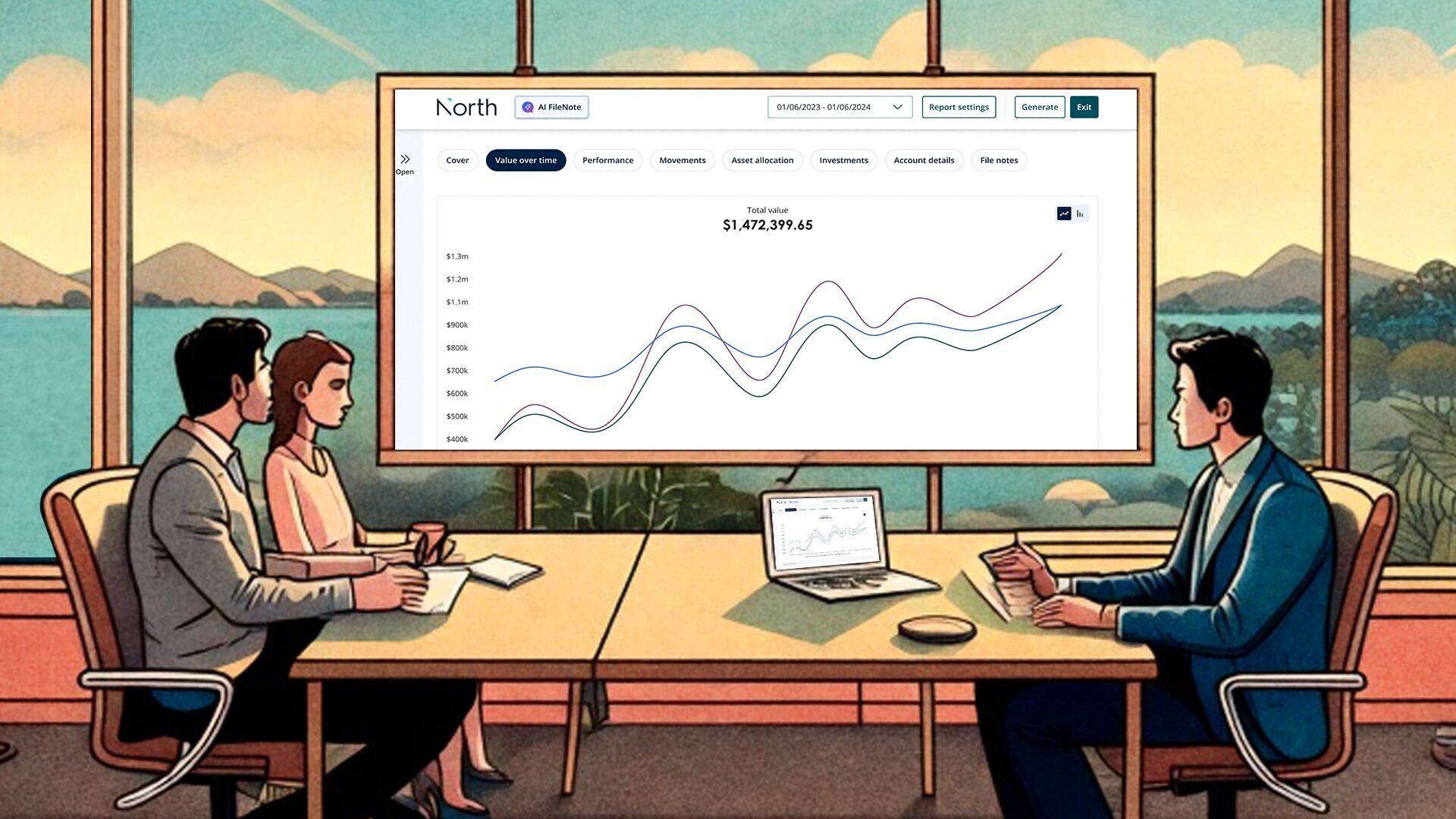

A new dawn for client reviews

With stunning visuals and innovative customisation options, North Interactive can save you time and enable powerful client conversations.

- Show real-time insights and bring data to life through an interactive presentation

- Transcribe client review meetings and create structured file notes with one click

- Consolidate data across multiple clients and accounts with ease.

Driven by continuous improvement

We pride ourselves on listening to advisers and continually look for ways to better meet your needs, and the needs of your clients. Here are just some of the improvements and additions we’ve implemented over the past few years, and there are more to come.

2022

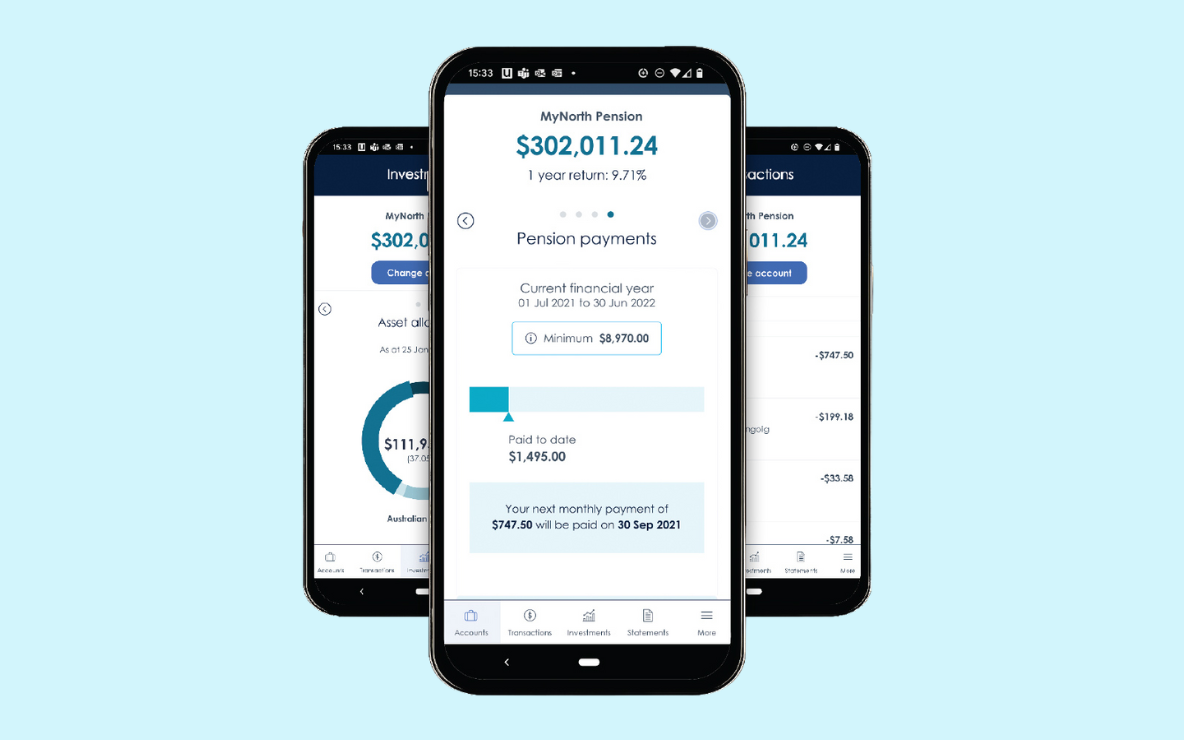

- Launched innovative MyNorth Lifetime solution

- Launch integrated investment switch ROA

- Client mobile app launch

- CGT estimates on proposed investment sells

- Digital consent for advice fees

2023

- Activity management: Online tracking progress bar

- Target client risk profiles vs actual

- New data feed recipients added

- Digital consent for bank charges

- Listed securities research integration (Sandstone)

2024

- Interactive client review with consolidated reporting across multiple clients

- Automated online Recontribution process

- Estimated completion time for in-progress trades

- Integrated % reweight to investment switch

- Clients can opt to share visibility of accounts

2025

- Enhancements to interactive client review tool

- AI-powered file note creation tool

- Activity management: upload documents and send messages on a case in platform

- +more

Bring your advice strategies to life

We're here to help

North Service Centre

Monday to Friday

8.30am - 7pm (Sydney time)

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.