Give your clients the ability to grow wealth, while their savings stay protected.

Market crashes are like earthquakes, everyone knows they are coming, but no one knows exactly when and the bounce back can be slow and painful.

We understand that as a client approaches retirement, their appetite for absorbing market losses reduces. That’s because a downturn in the market may be a detour they may never recover from.

With MyNorth Guarantees your clients can have the best of both worlds - they can remain in growth assets and benefit from gains, while also ensuring that their savings are protected from falls in the market.

Helps to safeguard your clients’ savings from major market downturns.

Helps grow your clients’ wealth when markets perform well so their nest egg lasts the distance.

Lock in any growth each year to increase the amount protected from market falls (optional for 5-year guarantees).

Get access to your clients’ funds at any time should their circumstances change.

How it works

Invest in a MyNorth Guarantee via MyNorth Investor Director Portfolio Service (or IDPS) or as a feature on the MyNorth Super and Pension product.

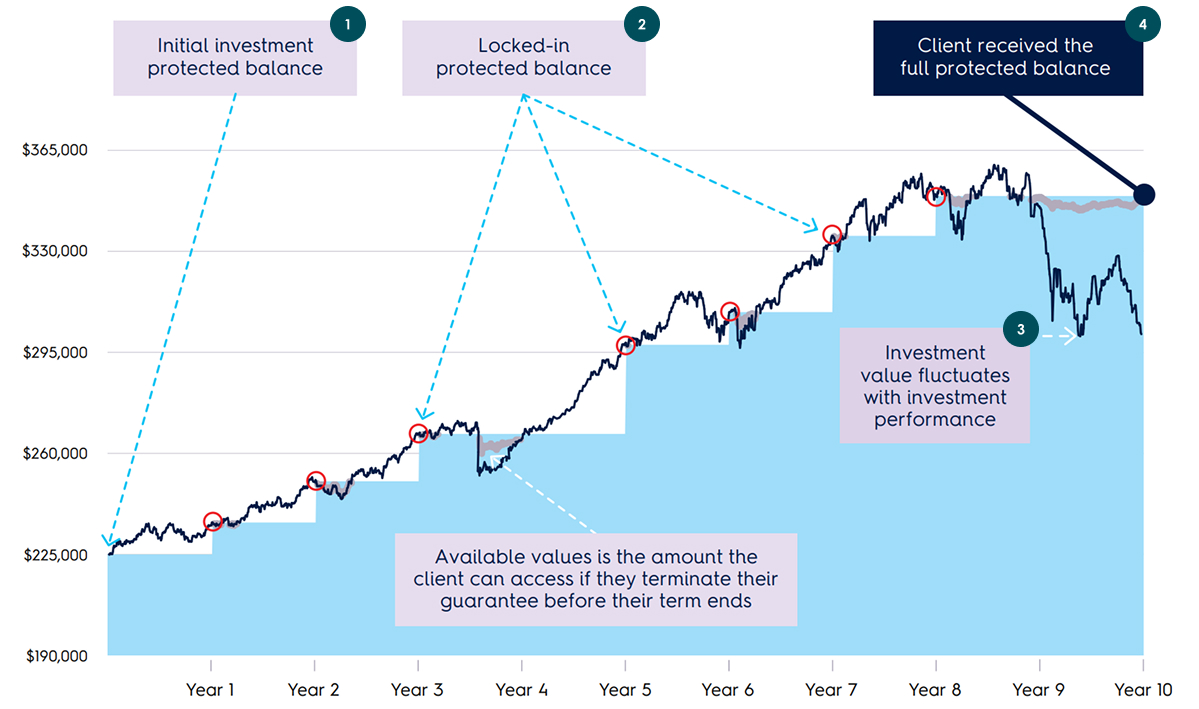

Client's balance ‘locks in’* annually on their anniversary date, potentially protecting against unfavourable market movements.

Client can access their part of the benefit if they terminate prior to maturity (available in the 10-year guarantee with vesting feature**).

Client will receive at least their protected balance at maturity but will always have access to their investment value at any time.

10-year Guarantee with a vesting feature

The below diagram is a hypothetical example of the fund might perform over the of term of a guarantee.

Resources

Put peace of mind on your side. Download our adviser guide.

Enter your details below

Privacy collection notice

The information you provide is being collected by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT) in order to respond to your enquiry. If you don't provide the information requested, NMMT may not be able to respond to your query. Your personal information may be shared with business areas or companies within the AMP Group. We may also provide information to local and overseas entities which provide AMP with administrative, financial, research or other services, other insurers and credit providers, financial planners, brokers and other organisations authorised by AMP to assist in reviewing customer needs. We may also disclose personal information to courts, tribunals and dispute resolution bodies, government agencies, and other bodies we are required to provide information to under the law. A list of countries where these providers are likely to be located can be accessed via the AMP Privacy Policy.

The AMP Privacy Policy provides more information about how we manage and protect the personal information we hold about individuals. It sets out how you can access and correct the information that AMP holds about you, how you may complain about a breach of privacy and our process for resolving privacy related enquiries and complaints.

We're here to help

North Service Centre

Monday to Friday

8.30am - 7pm (Sydney time)

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

*The 'lock in feature is standard on all 10-year guarantee options. The 'lock in' feature is an optional feature in the MyNorth Essentials IndexBalanced Fund (5-year term). This could help protect against unfavourable market movements, but this depends on when the protected balance is locked in.

** This is the available value which is always at least equal to the investment value, plus potentially a portion of the protected.

***The growth lock-in feature is not available as part of the 5-year guarantee non lock-in option.