For over 30 years, Australia fought a great national crusade to provide dignity in retirement. Is it working? The numbers suggest so.

Our superannuation coffers now hold $2.3 trillion1 - that’s nearly 150% of GDP. In 2022, pension flows out to members were worth nearly 7% of GDP.

The evolution of our super system changed our country by altering expectations of how old age is lived.

AMP Head of Investment Strategy and Chief Economist Shane Oliver says,

“Super underpinned capital flows into our economy and picked up the tab for much of our national infrastructure. It also made us a nation of mini capitalists. Super created a feeling of financial independence.”

We’re getting there – the changing face of retirement

There’s growing evidence the system is doing what it was designed to do. Firstly, the cost of retirements is falling more lightly on the taxpayer. The Retirement Income Review suggests that by 2060 the number of eligible Australians on the age pension will fall from 71% to 62%. Conversely, the number receiving a part rather than full age pension will rise from 38% to 63%.

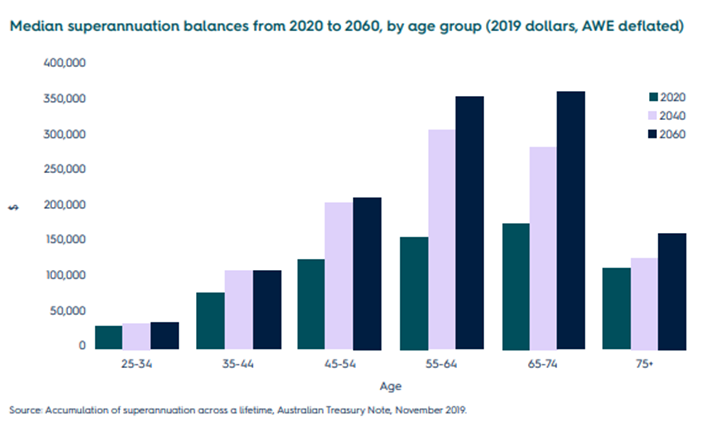

At the same time, a dignified, comfortable retirement could be available to more people. The average range of retirement capital outcomes is getting higher. According to Treasury’s Intergenerational Report, the median super balance at retirement in 2020-21 was around $125,000. By 2060-61 it will be around $460,000 (measured in 2021 dollars). Healthy retirement balances will be more common. In 2020, 65% of retirees entered retirement with an average super balance under $250,000. By 2060 fewer than a third of Australians are expected to retire with a balance that low.

More Australians will retire ‘rich’. By 2060, 13% will retire with a super balance worth a million or more2. The unknown is how much that sum will really mean by then.

“‘The Great Risk Transfer’3 means we’ve put a whole lot of responsibility on the individual,” says John Perri, Head of Technical Stratefy at AMP.

“Some people retire without a house, some with multiple houses. We all have completely different super journeys. And that means we’ll have different journeys in retirement.”

The Treasury chart above highlights the effect the maturing of the super system is having on the retirement prospects of Australians.

Yet as always with financial aggregates, big numbers obscure distinct human realities. Someone retiring in 2020 after an uninterrupted work life would have spent the first 12 years without compulsory super4.

And while there’s good news in aggregate, individual retirees and pre-retirees face a wall of real worries. For many pre-and early retirees, Fear of Running Out (FORO) is a major anxiety, especially as the growing cost of living eats away at your lifetime savings.

AMP’s guide to retirement income

This is an edited chapter from Retire with Confidence – AMP’s guide to the new world of retirement income. If you’d like to read more, download the full paper here.

1 Mercer CFA Institute Global Pension Index, 2022.

2 Superannuation balances at retirement, Treasury Information Note, 2019.

3 Perhaps first discussed in The Great Risk Shift by Jacob S Hacker in the early 2000s.

4 Treasury Information op. cit

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.