Authored by

Stuart Eliot, Head of Portfolio Design and Management

Jonas Benner, Senior Quantitative Researcher

This is the first in a series of educational notes about the role of store of value investments in a diversified portfolio.

Part 2 will make the case for Bitcoin as an emerging store of value investment.

Part 3 will examine the impact of allocating to this type of investment within a diversified portfolio.

What is a store of value investment?

A store of value investment is one that derives at least part of its value from a general acceptance among investors that it will maintain its ‘real’ value. That is, its purchasing power after the impact of inflation over time. This does not mean that the price is stable, or will always go higher, but it should be the case that its value rises at least in line with inflation over the medium to long term. Further, price appreciation of the investment will likely be strongest when actual inflation, or fears of future inflation, are running high. This draws in new investors seeking to protect their purchasing power. Once the period of inflation has passed, it may be the case that these investors will then sell some of, or all their holdings of the investment, resulting in a decline in the price. In a deflationary environment, store of value assets may experience price declines as demand for inflation protection wanes and liquidity preference rises. Long-term, their real value is expected to roughly track purchasing power trends.

To some, of course, the term ‘store of value investment’ may invite scrutiny, depending on how it is interpreted.

An ‘investment’ could be thought of as an asset purchased with the goal of generating returns through income or capital gain. A ‘store of value’ meanwhile could be a function of a money-like asset, whereby it retains its purchasing power over time, allowing wealth to be preserved into the future with, ideally, no loss of value. In reality however, some assets can provide a mix of these attributes and, of course, come with different risk/return profiles, thus the differences between these categories are not always black and white.

A brief history of gold

The most well-accepted store of value investment is gold, which has performed this role for many centuries.

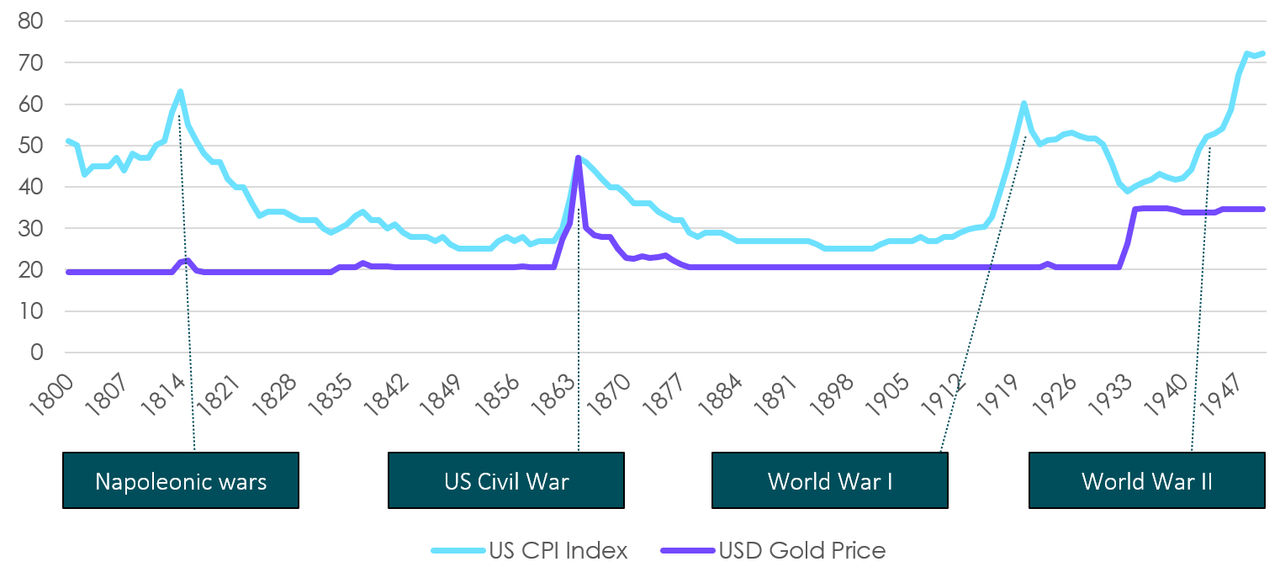

In antiquity, gold and silver typically served as currency, until governments eventually began to issue paper money backed by gold and/or silver, which was known as the ‘Gold Standard’. Governments specified a fixed conversion ratio between gold and their currency, and inflation remained relatively well behaved, with the price level generally only rising in response to war, as can be seen in the following chart.

US CPI Index and USD Gold price 1800 to 1950

Source: Federal Reserve Bank of Minneapolis, onlygold.com

In 1933 US President Franklin D. Roosevelt outlawed private ownership of gold, forcing investors to sell their gold to the government. Soon afterwards Roosevelt raised the gold price in US dollars by 70%, in other words devaluing US dollars by 41% relative to gold.

In 1944 the Bretton Woods agreement made the US dollar the ‘official’ global currency, with all other currencies set at a fixed exchange rate to the US dollar and the US dollar being convertible to gold, known as ‘the peg’, at a fixed $35/ounce. By the 1960s, US trade deficits, Vietnam War spending, and foreign aid created a glut of US dollars abroad, while US gold reserves remained relatively fixed. This imbalance made the US dollar overvalued and vulnerable to speculative attacks.

Governments’ attempts to defend the peg by selling gold and buying US dollars caused official reserves to fall sharply, resulting in more foreign-held US dollars than the US had in gold, eroding confidence in the system. In addition, rising prices originally stemming from OPEC’s control of oil prices, led to falling growth and rising unemployment (the dreaded ‘Stagflation’) putting further pressure on the US dollar. Ultimately, persistent balance of payment deficits made it impossible to prevent the US dollar from depreciating relative to gold, and in 1971 the US was forced to abandon its commitment to a fixed rate of convertibility between gold and the US dollar, and both were subsequently allowed to float according to market forces.

This last point is crucial. For essentially the first time in history, money was no longer tied to a physical commodity. It became government-issued currency backed only by legal authority and public confidence - a system known as ‘fiat

money’. Unlike commodity-backed money, fiat currency has no redeemability into a tangible asset such as gold or silver. Its value is derived from its status as legal tender and the collective trust that others will accept it in exchange, rather than from any physical scarcity or alternative non-monetary uses.

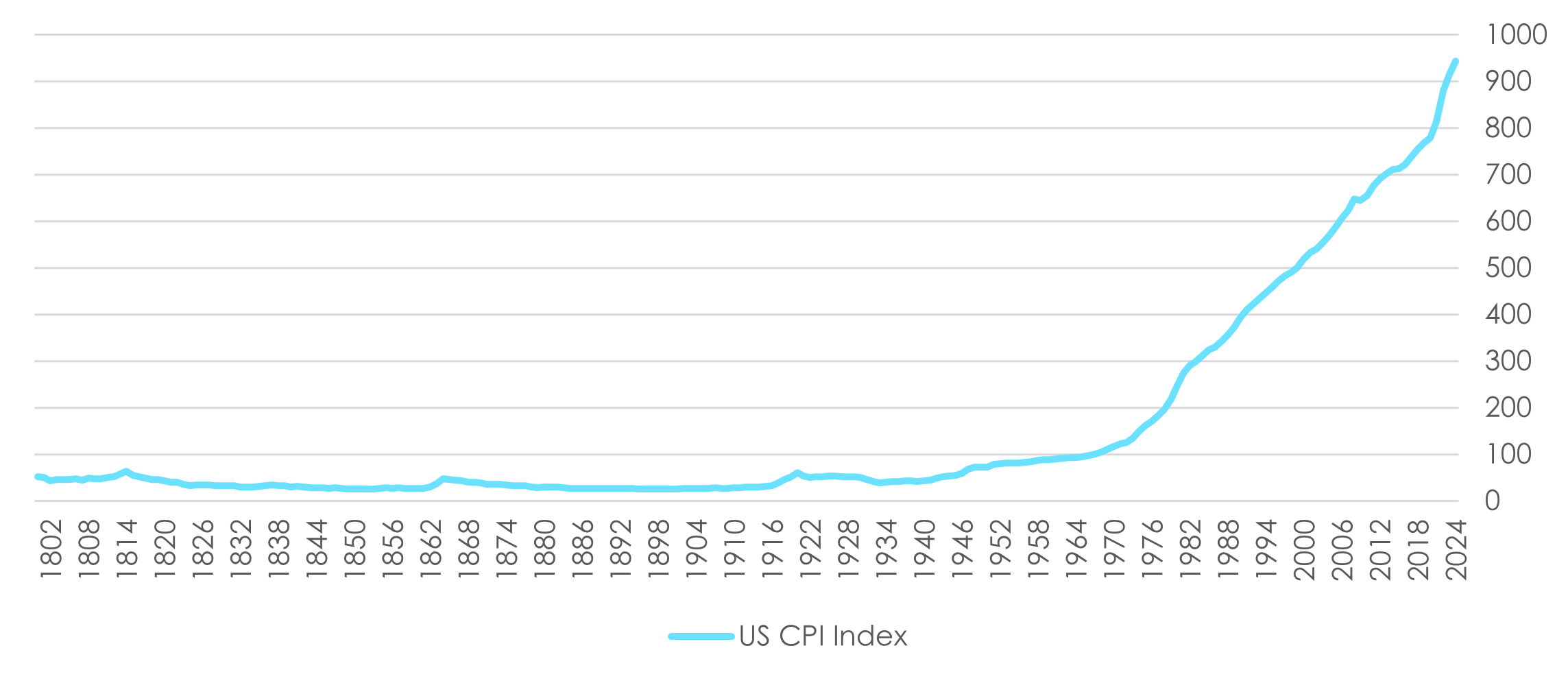

Without the constraints imposed by gold backing, governments were suddenly able to create more money out of thin air, after which a funny thing happened! Here is that same US inflation chart again but extended to 2024.

US CPI Index 1800 to 2024

Source: Federal Reserve Bank of Minneapolis

Inflation had already been rising as mentioned above, but after 1971 it really took off. As of 2024, the purchasing power of the US dollar has dropped by 87% since the US stopped issuing dollars backed by gold in 1971. Other currencies suffered similar fates, many far worse.

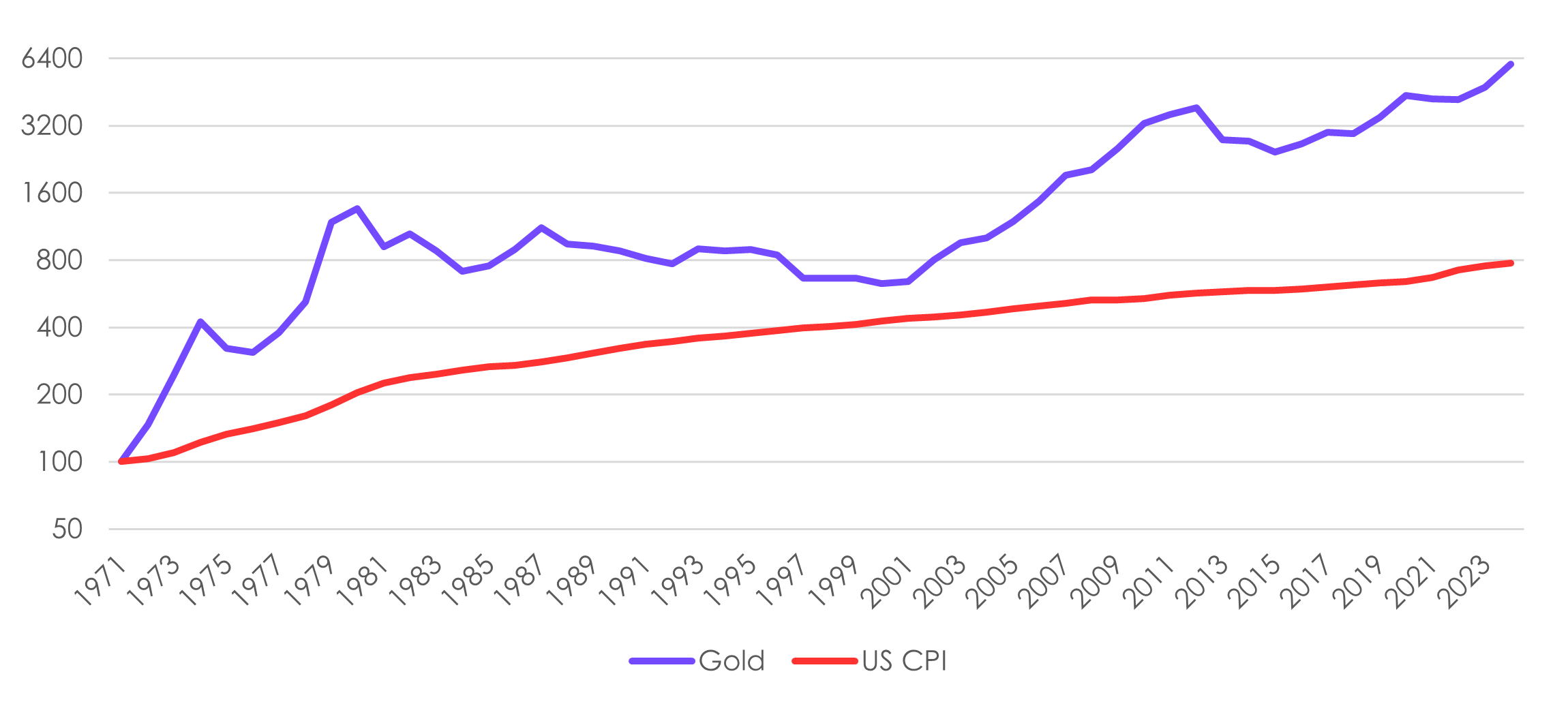

Gold returns versus CPI, indexed to 100 in 1971 (log scale)

Source: Bloomberg

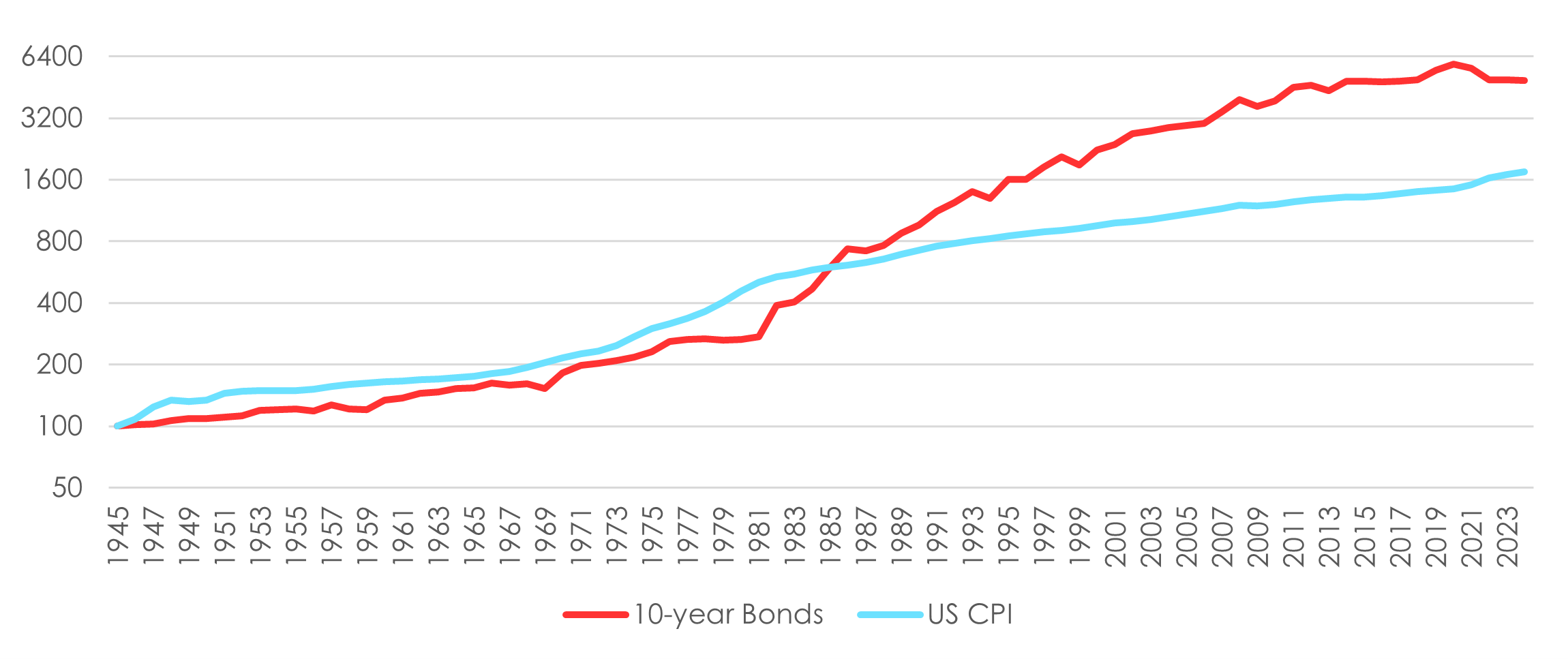

It’s harder to see in the previous chart because of the dramatic change post 1971, but the cumulative increase in the price level from the end of WWII in 1945 until when gold convertibility was abandoned in 1971, was a staggering 125%. This is great news if you owe a lot of money denominated in nominal dollars, as governments did, because the debt gets inflated away! In 1945 the US government had accumulated a debt-to-GDP ratio of 119% (slightly less than where this ratio is now), which subsequently fell to 35% in 1971. Bad news, however, if you were a US bond investor in 1945 – you’d have had to wait over 40 years to break even on your investment after accounting for inflation1 as can be seen below. What fate awaits the current generation of bond investors?

US 10-year Bond returns versus CPI, indexed to 100 in 1945 (log scale)

Source: Federal Reserve Bank of Minneapolis, Bloomberg, Prof Robert Shiller

What makes a good store of value?

Thus far we have discussed gold in the context of being an effective store of value investment without going into depth about what are the ideal properties of an effective store of value, aside from the price going upto protect against inflation.

Drawing from history and economic theory, we can distil several key properties:

- Scarcity: Limited supply prevents dilution of value.

- Durability: Physical resilience – a good must not be perishable – or digital resilience – a digital good must be resistant to change or destruction, which ensures longevity.

- Portability: Ease of transfer across space and time.

- Divisibility: Ability to subdivide without losing value.

- Fungibility: Interchangeability of units for consistent valuation.

- Verifiability: Assurance of authenticity and ownership.

- Sovereign Risk Resistance: Protection from confiscation or control by centralised authorities.

- No/Low Cost of Storage: Minimal expense to maintain the asset over time.

- Liquidity: Ability to quickly convert into cash or other assets without significant loss of value.

- Track Record: An established history of retaining or appreciating in purchasing power across economic cycles.

No asset perfectly embodies all these traits, but the closer an asset aligns with them, the stronger its case as a store of value2.

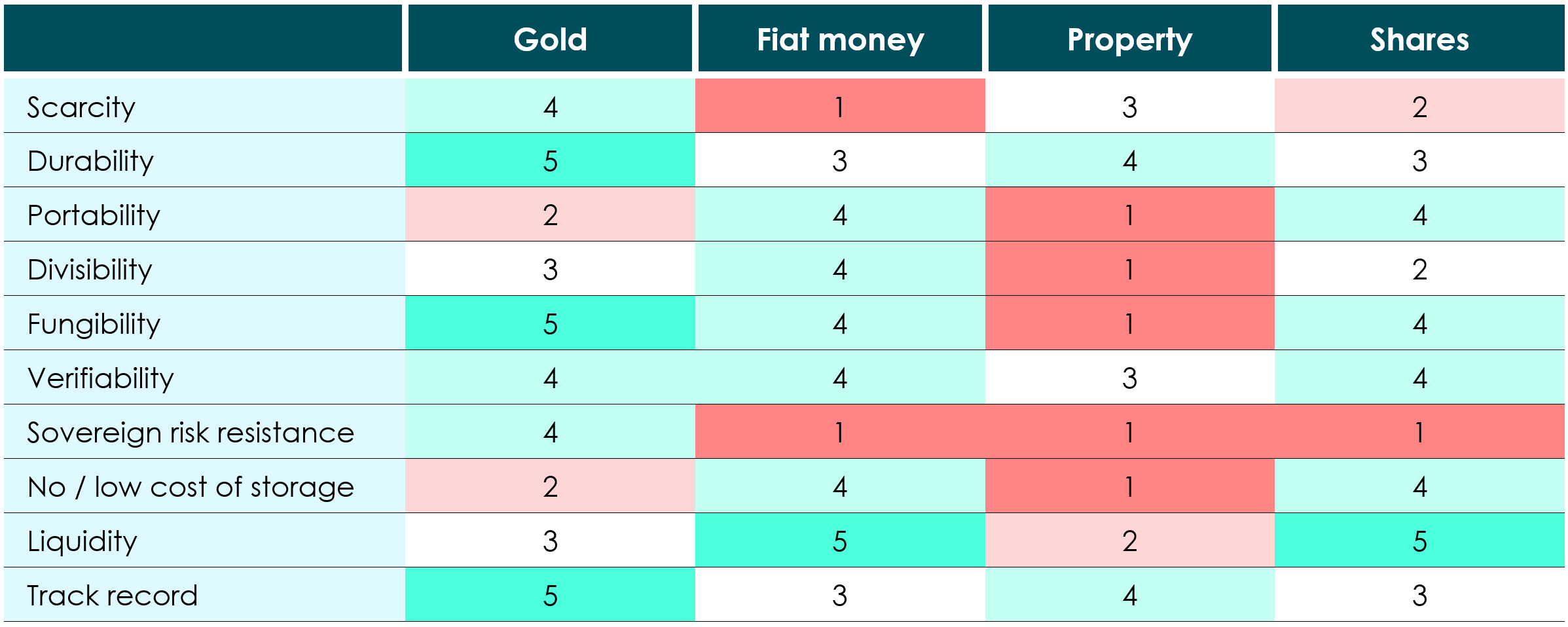

We can rank investments typically used to preserve or grow real wealth (gold, cash, shares, property) against these criteria. We have our own subjective view of the rankings but instead asked ChatGPT-5 to do the rankings for a more objective view. The results are quite similar to our own.

Each asset type is ranked from 5 (best) to 1 (worst) for their relative satisfaction ofeach criterion specified. Source: ChatGPT-5

What's next?

Having explored the role and effectiveness of gold as a store of value investment, in part 2 of this series (coming in December) we will extend the analysis to include Bitcoin. Spoiler: we think that Bitcoin is an emerging store of value investment.

MyNorth Lifetime Conversations

19 July 2024 Our CEO, Alexis George recently caught up with Director and Principal Planner at CLS Investment Services, Mende Dulevski, to discuss MyNorth Lifetime and the impact that it's having on his business and clients. Read more

Why I use North - Mina Nguyen, Director of Essense Wealth

31 May 2024 In the latest instalment of our interview series with leading advisers, we caught up with Mina Nguyen of Essense Wealth. Read more

Amy's story

17 April 2024 Amy opens a MyNorth Lifetime Super account with a balance of $447,076. She has a $355,568 purchase amount, and potential age pension increase due to her 40% Centrelink discount. Read moreImportant information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

This article is for professional adviser use only and mustn’t be distributed to or made available to retail clients. It contains general advice only and doesn’t consider a person’s personal goals, financial situation or needs. A person should consider whether this information is appropriate for them before making any decisions. It’s important a person considers their circumstances and reads the relevant product disclosure statement and/or investor directed portfolio services guide, available from NMMT at northonline.com.au or by calling 1800 667 841, before deciding what’s right for them. You can read the NMMT Financial Services Guide online for more information, including the fees and benefits that AMP companies and their representatives may receive in relation to products and services provided. You can also ask us for a hard copy.

1 Calculated using 10-year US government bond yields

2 There is some overlap between the list of attributes that define a good store of value and the attributes that define a good investment, e.g., gold versus shares. For an investment we would include criteria related to cash flows for instance but note that the generation of cash flows is explicitly not a desired attribute of a store of value.