A better way for client reviews is here.

Alongside one of the strongest platform integrated ROA capabilities, and innovative features like North’s risk profiles, we’ve now introduced an all-new interactive client review tool. And it’s making a real difference for advisers.

“ I can get through everything I need to in the client review in 90 seconds if I need to. I’ll have answered every question that they need. That’s the absolute proximity. You don’t want to have to go walk through cranes worth of paperwork to try to get to the point of it.”

– Adam Renouf, Managing Director and Senior Financial Advisor at Renouf & Partners.

Here are four powerful ways North Interactive can take your reviews to the next level.

1. Free up practice time and resources with consolidated multi-account reporting

Advisers now have the option to merge data across a group of accounts (showing the full picture), show accounts individually or a combination of both in a single report. This can be a big time saver.

Additionally, the new interactive review allows advisers to create and name their own groups, selecting one or more of the clients open or previously closed accounts. But that’s only one part of the many new customisation options.

2. Tell your clients a personalised story, in the format that suits best

Advisers can now create a more tailored review experience with ease, that truly showcases the value of their advice. Here are a few of the capabilities:

- Digital Presentation mode – Bring your advice to life as you present to your client with a slick digital presentation which incorporates stunning visuals.

- Choose your preferred output– Email the client a PDF copy, with all your customisation incorporated, or store a soft copy in the client’s statements and correspondence section. Alternatively extract specific content from the Word output and modify as required.

- Customise settings – Mirror the preferred flow of a client conversation by changing the order of content, removing sections all together or customising settings before generating your review report or presenting in digital interactive mode.

- Include your own commentary and file notes – Add colour and tailor information to client advice goals with your own commentary.

3. Make it your own by adding your practice brand

North Interactive’s digital presentation mode and exportable reports can be branded for practices.

Advisers may choose to remove the North logo, and instead add their own practice logo and look.

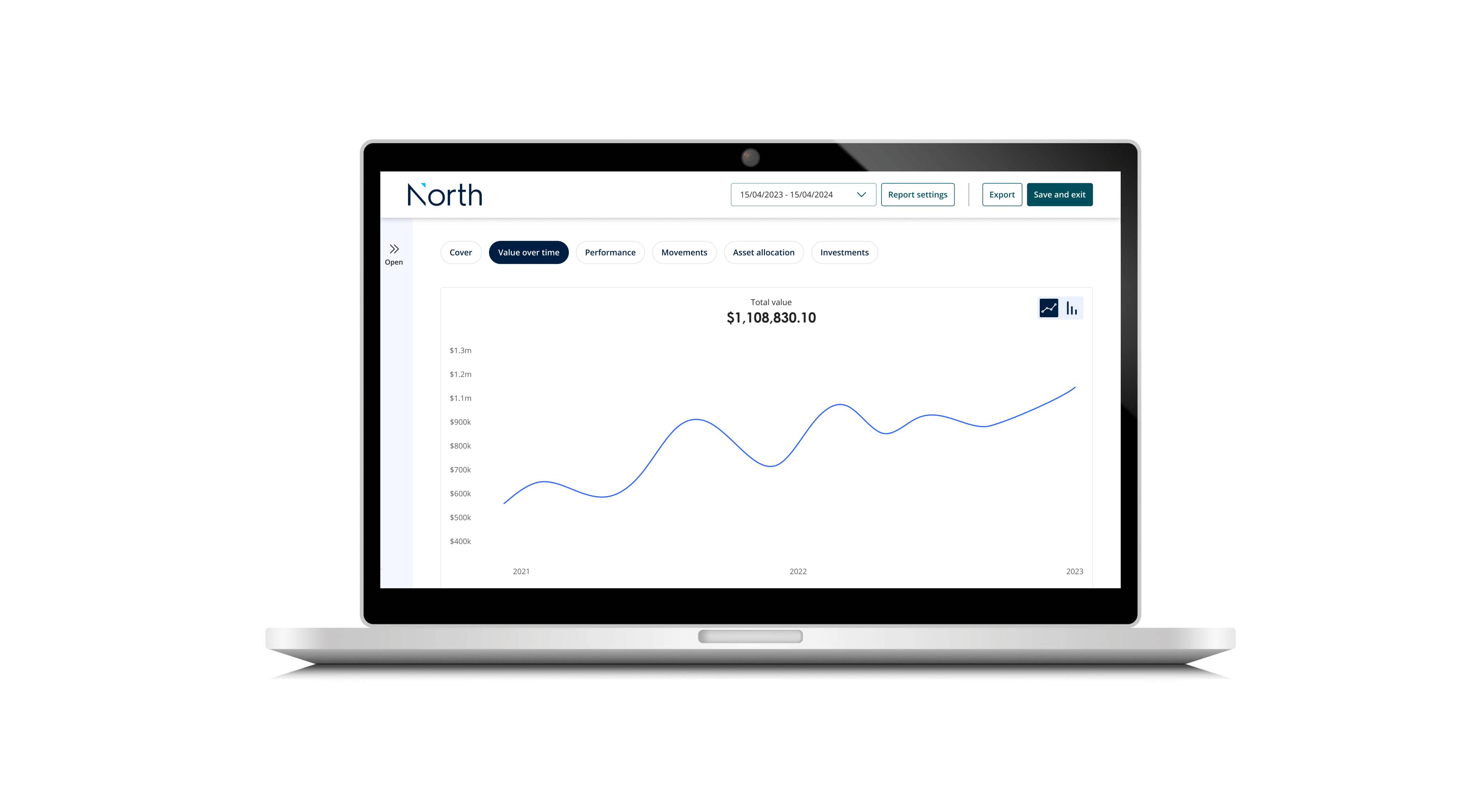

4. Stunning new digital charts to visualise the value of your advice

Our new digital charts allow advisers to better showcase:

- Value over time – Visually represent your client balance history since joining North net of any account transfers and customise the period you prefer.

- Summary of movements – View a simple summary of key changes including money in, money out and investment performance across all or selected accounts.

- Account performance - Easily compare your client’s performance using our new charting tool to compare against benchmark indices or any investment available on North’s vast Investment menu.

- Investment performance - Drill down into an individual investment holdings performance and view income versus growth from market movements to find out how it impacts your client's overall outcomes.

- Asset allocation & risk profile - Try our new asset allocation charts and view how your client sits compared to their target risk profile ranges.

Each of these are available in a consolidated format which merges all accounts in a single view, by individual account or a combination of both.

So there are multiple ways North Interactive will transform client review experiences. And there’s plans for more to come still.

For more information on how North Interactive could change the game for you, contact us or chat to your BDM.

How to stay scam aware this silly season

24 November 2025 Remaining vigilant about data and digital security is particularly important around holiday season as phishing attempts increase. The North team want to share a few reminders for you and your clients on staying safe online. Read more

Activity Management: Your workflow enhanced

05 November 2025 We are committed to supporting you in delivering exceptional service and streamlining your client workflows. That’s why we encourage you to take full advantage of the Activity Management feature available in North Online. Read more

North RoA Enhancements: Faster, Smarter, Simpler

29 October 2025 At North, we’re committed to making your advice process as seamless and efficient as possible. That’s why we’re excited to introduce the latest enhancements to the Record of Advice (RoA) experience on North—designed to save you time, minimise manual work, and help you deliver even greater value to your clients. Read more

Important information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.