Authored by

Jonas Benner, Senior Quantitative Researcher

Stuart Eliot, Head of Portfolio Design and Management

This is the second in a series of educational notes about the role of store of value investments in a diversified portfolio.

In Part 1 of this series, we explored the role of gold as a store of value investment and introduced a framework for thinking about assets whose primary purpose is to preserve, and ideally grow, purchasing power over time.

In this second part we turn to a much newer candidate: Bitcoin. Since its launch in 2009, Bitcoin has evolved from novel open-source monetary network into a globally traded asset held by individuals, companies, and an increasing number of institutions. Many prominent investors and institutions – from BlackRock’s Larry Fink1 and Goldman Sachs2 to Fed Chair Jerome Powell3 - have referred to it as 'digital gold' – a form of hard money designed for the internet age.

Our goal here is to explain what Bitcoin is at a high level, why some investors view it as an emerging store of value, and how it compares with gold and other assets through the same lens we used in Part 1.

What is Bitcoin?

Bitcoin is a decentralised digital monetary network. At its core it is a way for people to hold and transfer value electronically without relying on a central authority such as a bank or government. The Bitcoin protocol caps the supply of Bitcoin at 21 million coins; although a change is theoretically possible, the decentralised consensus required makes it practically implausible. Bitcoin is therefore the first widely adopted digital asset with credibly verifiable scarcity. As of late 2025, around 20 million Bitcoin have already been mined (i.e. supplied).

Bitcoin transactions are recorded on a shared public ledger known as a blockchain. This ledger is maintained by thousands of independently operated computers around the world, all running compatible Bitcoin software. Anyone can verify the history of transactions themselves.

Specialised computers, known as miners, bundle new transactions into blocks and compete to add these blocks to the ledger. They do this by performing energy-intensive computations, a process known as proof of work. The miner that creates a valid proof of work first receives a block reward – newly issued Bitcoin plus transaction fees. The amount of newly issued Bitcoin halves roughly every four years and will asymptotically cap the total supply at 21 million. This 'work' makes it extremely costly to rewrite history or counterfeit coins, providing security without the need for a central authority.

Ownership of Bitcoin is controlled by cryptographic keys. With these keys, holders can send value directly to one another over the internet, with transactions typically settling within minutes. Bitcoin is not a company, has no central management team and does not represent a claim on future cash flows. Instead, like gold, it is a bearer asset: its value lies in the fact that others are willing to hold and accept it in exchange.

Bitcoin as 'digital gold'

It is helpful to understand why many investors draw a direct comparison between Bitcoin and gold.

First, both are hard to debase. Gold is scarce because it is difficult and costly to mine. Bitcoin is scarce by design: its supply schedule is encoded in the protocol and enforced by the network. No central bank or government can decide to 'print' more.

Second, both embed proof of work. Gold mining converts energy and capital into new gold, and the accumulated stock represents the embedded work of centuries of mining. Bitcoin mining likewise converts energy and capital into new coins and network security. The ledger’s integrity is protected by the ongoing expenditure of energy and specialised computing hardware, which would need to be repeated, at enormous cost, to change past records.

Third, both are neutral global assets. Neither gold nor Bitcoin is issued by a single country or company. Both trade globally and can be held by anyone with access to the relevant infrastructure – vaults for gold, and the internet plus secure storage for Bitcoin.

Finally, neither is anyone’s liability. Unlike bonds or bank deposits, neither gold nor Bitcoin is a promise issued by another party. There is no credit risk, and their value does not depend on the solvency of an issuer.

These parallels underpin the 'digital gold' label: Bitcoin seeks to replicate and, in some respects, improve on gold’s monetary properties in purely digital form.

There are, however, important differences. Gold has served as money and a store of value for millennia. Bitcoin, by contrast, is just over 16 years old and has experienced substantial price volatility. Its long‑term potential remains tied to continued adoption and confidence in the protocol.

Gold is a tangible commodity with uses in jewellery and industry and is held in significant reserves by central banks. Bitcoin is purely digital and has value only as a monetary asset. This makes Bitcoin easier to store and transfer, but also means its value is primarily driven by its monetary role. Some observers view gold’s industrial and jewellery demand as an 'anchor' for its price. Others argue that a monetary asset with no alternative use case, like Bitcoin, is in some ways a purer form of money, because its supply and demand are driven solely by its role as a monetary good and store of value rather than by competing industrial needs.

Moving large amounts of physical gold is costly and slow, whereas Bitcoin can be transferred globally in minutes and divided into 100 million smaller units ('satoshis'), enabling transactions of almost any size. Gold enjoys a longer track record and lower price volatility; Bitcoin offers superior portability, divisibility and ease of transfer.

Revisiting the store of value framework

In Part 1 we ranked gold, fiat money, property and shares on the 10 key properties of a store of value. Here we extend the analysis to include Bitcoin.

Each asset type is ranked from 5 (best) to 1 (worst) for their relative satisfaction of each criterion specified. Source: ChatGPT-5

Taken together, this framework suggests that from first principles Bitcoin scores more highly than any of the traditional assets commonly used as stores of value today. It combines absolute scarcity, infinite durability, effortless global portability, fine-grained divisibility, easy verifiability, strong resistance to confiscation and very low storage costs in a single, purely monetary asset. No other asset in the table offers this particular combination of properties, which is why many see Bitcoin as a genuine monetary breakthrough rather than just another risk asset.

What about stability?

At this point a natural question arises: if a store of value is meant to store value, shouldn’t it be relatively stable? How can an asset as volatile as Bitcoin credibly claima role in this category?

In the very long run, what matters for a store of value is preserving or growing purchasing power, not short-term price stability. Even gold, which we now view as a mature store of value, went through long periods of re-pricing and regime change as it moved in and out of different monetary systems. Prices can be quite volatile while the market is still working out what an asset is, how widely it will be used and how large its total market should be.

Bitcoin is still in the early stages of monetisation and adoption. One useful way to think about this, popularised in 'The Bullish Case for Bitcoin'4, is that monetary assets tend to move through phases: first as a collectible held by a small group of believers, then as a store of value, and only later as a widely used medium of exchange and, eventually, a unit of account. In the early collectible and store-of-value phases, volatility is a feature rather than a bug: the market is discovering a price as new participants arrive, expectations shift and liquidity deepens.

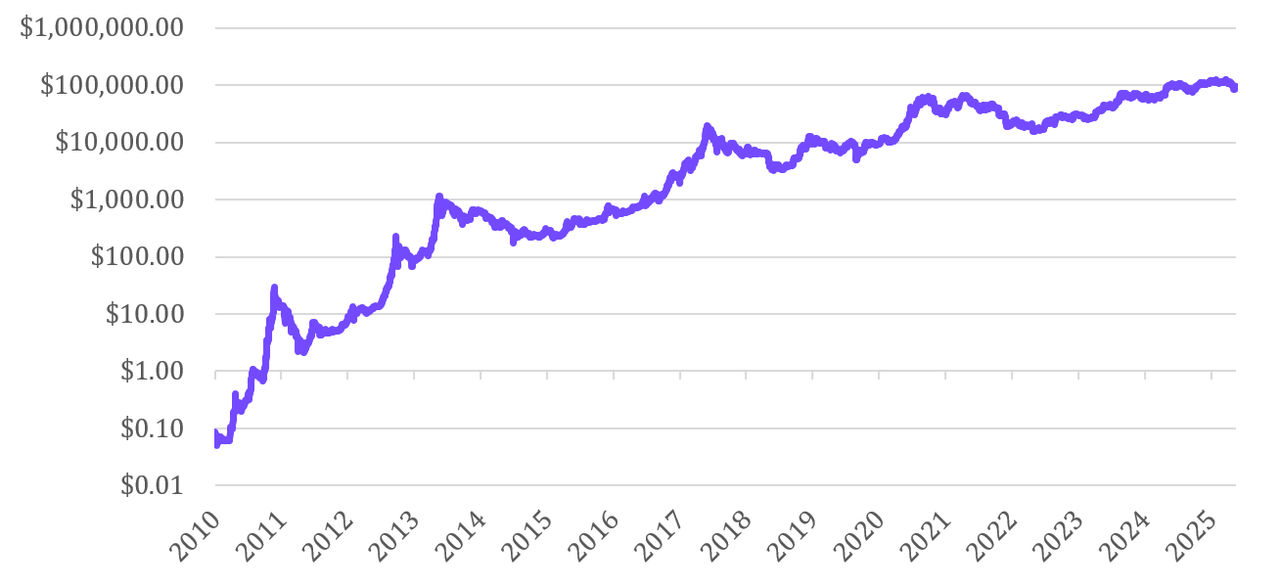

The chart below plots Bitcoin’s price on a logarithmic scale, which is better suited to assets that have moved across multiple orders of magnitude. It highlights three features:

(i) cyclical monetisation - expansion and contraction phases as adoption deepens;

(ii) declining amplitude compared with the earliest years, consistent with broader market depth; and

(iii) the importance of a long‑horizon lens - short‑term drawdowns can be severe even within a longer upward adoption trend. A log view helps avoid recency bias from the latest cycle dominating the entire chart on a linear axis.

Historical Bitcoin price on a logarithmic scale

Source: CoinMetrics, starting date: 18 July 2010

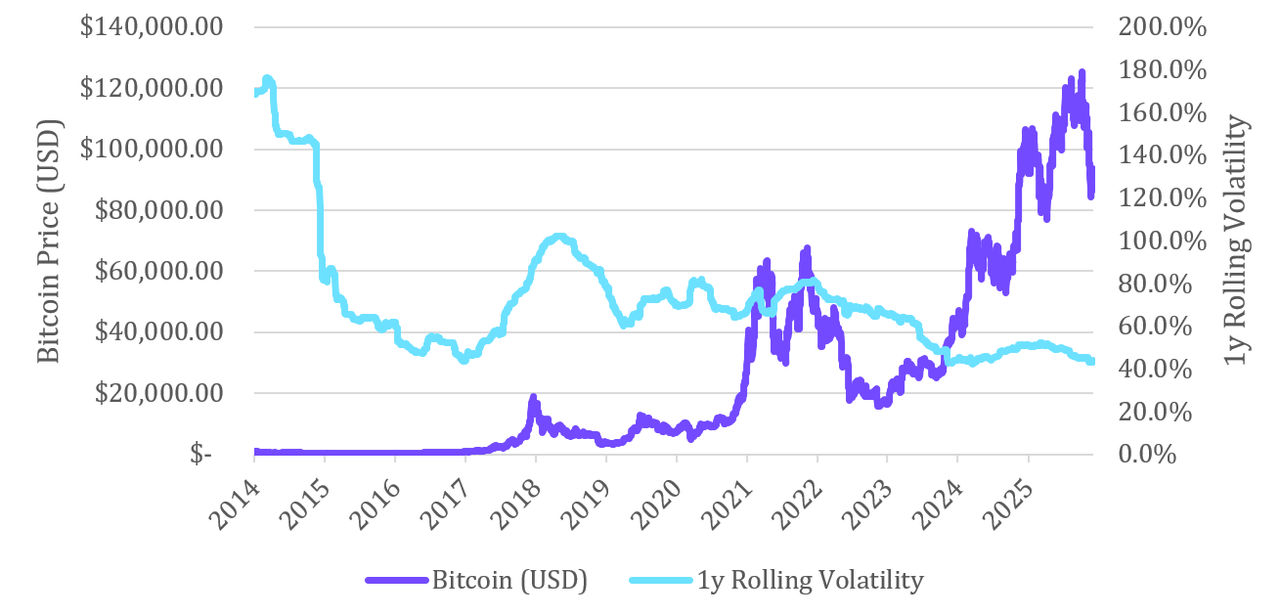

As adoption has broadened, Bitcoin’s volatility has already declined meaningfully compared with its earliest years, as the below chart shows, and based on what have seen from other monetary assets it is reasonable to expect that, if adoption continues, volatility will tend to fall further over time.

Historical Bitcoin price and 1-year rolling volatility

Source: Bloomberg, starting date: 1 January 2014

For now, though, Bitcoin remains significantly more volatile than gold or major currencies. That volatility is the price investors pay for exposure to a scarce, emerging monetary asset with asymmetric upside as the world gradually decides what role it should play.

For investors, the implication is not that volatility disqualifies Bitcoin as a store of value, but that any allocation needs to be sized appropriately within a diversified portfolio and viewed through a long-term lens. In this context, short-term price swings are best seen as part of the journey of a new asset moving along the monetisation curve, rather than as a sign that it cannot ultimately serve a store-of-value role.

Market behaviour: correlation and cycles

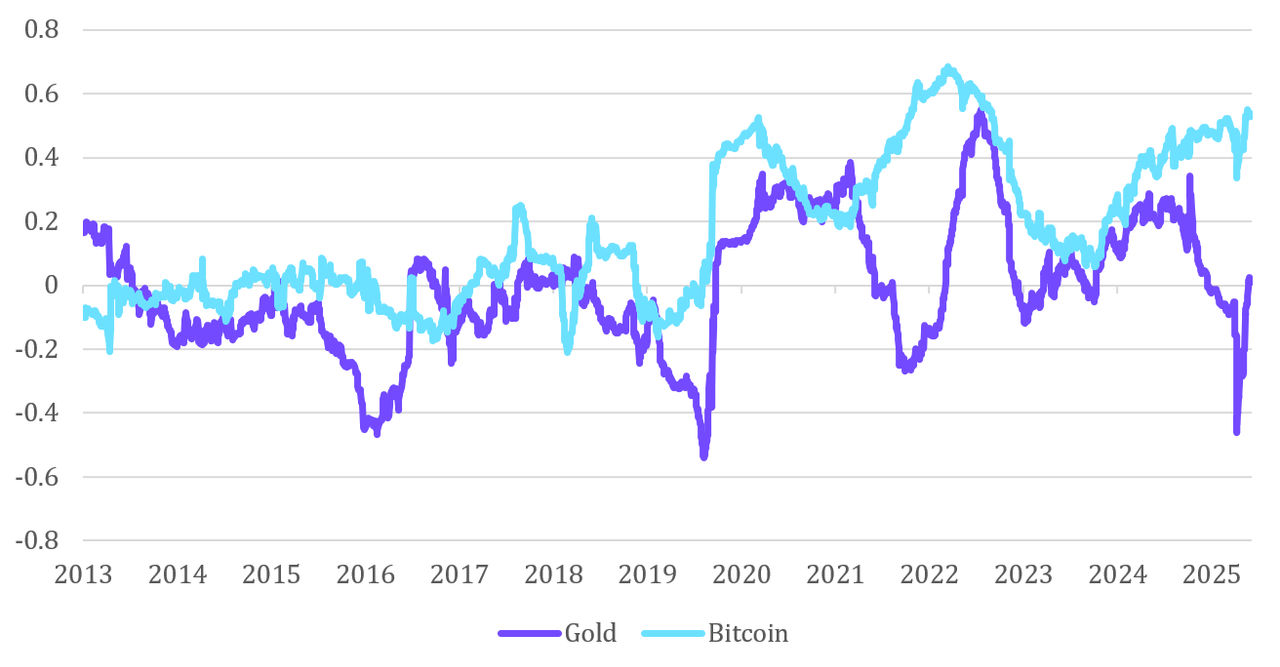

A common concern is that Bitcoin has, at times, tracked risk assets, particularly US growth equities, more closely than one would expect from a store of value. The chart below shows the rolling 6‑month correlation between the Nasdaq and both Bitcoin and gold. Two points stand out. First, correlations are regime‑dependent and unstable. Short windows are especially sensitive to liquidity cycles and prevailing investor positioning (crowded trades, leveraged futures/ETF flows). Second, Bitcoin’s correlation has been higher in recent years as macro drivers that lift or tighten all risk assets - US dollar liquidity, real yields, discount rates and global financial conditions - have exerted a larger influence as market depth, derivatives and institutional participation have grown. Looking ahead, if Bitcoin’s investor base continues to broaden from speculative or trading demand toward unlevered, long‑horizon savings demand, we would expect its correlation with equities to be lower and more variable, more akin to gold’s pattern over time. Correlations are a moving target and should be monitored rather than assumed.

Rolling 6-month correlation between the Nasdaq and both Bitcoin and gold

Source: Bloomberg, starting date: 3 July 2013

Why Bitcoin is not the same as 'crypto'

Bitcoin is often grouped together with a broad range of other digital assets under the umbrella term 'cryptocurrency'. However, from a store‑of‑value perspective, there are important distinctions.

Bitcoin was created with the explicit aim of being decentralised, censorship‑resistant money with a fixed supply. Many other digital assets are designed as platforms for applications, governance tokens for projects or experiments in new financial structures. Their economics and risk profiles can resemble venture capital or early‑stage technology investments more than money.

Bitcoin has no central issuer, no founding allocation and a transparent, unchanging issuance schedule. In contrast, many other crypto assets have large founding allocations, flexible supply policies or governance structures that allow parameters to be changed by a relatively small group of insiders.

Bitcoin’s proof‑of‑work network is decentralised: miners are spread across many jurisdictions and compete to add blocks while tens of thousands of independently run nodes (computers) validate all transactions and enforce the rules. Other networks may be more centralised or rely on governance mechanisms that concentrate power among a subset of participants.

For these reasons, when we consider store of value characteristics, it is useful to analyse Bitcoin separately from the broader 'crypto' universe. While other digital assets may have interesting technological or speculative properties, none so far exhibit the same combination of scarcity, security, decentralisation, and monetary focus that characterise Bitcoin.

Bitcoin in an increasingly digital world

We live in a world of high sovereign debt levels, concerns about long-run purchasing power under positive-inflation targets, and rapid digitisation of financial infrastructure. Against this backdrop, Bitcoin offers something novel: a digital, scarce, globally accessible asset with no central issuer and a predictable supply.

For some investors, Bitcoin is beginning to play a role similar to that historically filled by gold – a hedge against monetary debasement and a complement to traditional financial assets. For others, it remains too new and volatile to be considered a core store of value. Both perspectives can be considered reasonable, depending on objectives, time horizon and risk tolerance.

What is clear is that Bitcoin has moved beyond a niche experiment. Its properties, and its growing adoption, make it a serious candidate for inclusion in discussions about stores of value in a diversified portfolio.

What's next?

In Part 3 of this series, we will bring the pieces together. Having examined gold and Bitcoin separately as potential stores of value, we will explore the impact that allocations to these assets can have within a diversified portfolio, and how investors might think about their respective roles alongside more traditional holdings.

___________________________________________________________________________________________________

1 CNBC

3 Nasdaq

4 Medium

MyNorth Lifetime Conversations

19 July 2024 Our CEO, Alexis George recently caught up with Director and Principal Planner at CLS Investment Services, Mende Dulevski, to discuss MyNorth Lifetime and the impact that it's having on his business and clients. Read more

Why I use North - Mina Nguyen, Director of Essense Wealth

31 May 2024 In the latest instalment of our interview series with leading advisers, we caught up with Mina Nguyen of Essense Wealth. Read more

Amy's story

17 April 2024 Amy opens a MyNorth Lifetime Super account with a balance of $447,076. She has a $355,568 purchase amount, and potential age pension increase due to her 40% Centrelink discount. Read moreImportant information

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). It contains general advice only, does not take account of your client’s personal objectives, financial situation or needs, and a client should consider whether this information is appropriate for them before making any decisions. It’s important your client consider their circumstances and read the relevant product disclosure statement (PDS), investor directed portfolio guide (IDPS Guide) and target market determination (TMD), available from northonline.com.au or by contacting the North Service Centre on 1800 667 841, before deciding what’s right for them.

MyNorth Investment and North Investment are operated by NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFSL 234652 (NMFM). MyNorth Super and Pension (including MyNorth Lifetime), MyNorth Super and Pension Guarantee and North Super and Pension are issued by N.M. Superannuation Proprietary Limited (ABN 31 008 428 322, AFSL 234654 (NM Super) as trustee of the Wealth Personal Superannuation and Pension Fund (the Fund) ABN 92 381 911 598. NMMT issues the interests in and is the responsible entity for MyNorth Managed Portfolios. All managed portfolios may not be available across all products on the North platform. All of the products above are referred to collectively as MyNorth Products. The information on this page is provided only for the use of advisers, it is not intended for clients. This page provides a brief overview of some of the benefits of investing in MyNorth Products. The adviser remains responsible for any advice/services they provide to clients including making their own inquiries and ensuring that the advice/services are appropriate and in accordance with all legal requirements.

You can read the Financial Services Guide online for more information, including the fees and benefits that companies related to NMMT, N.M. Superannuation Proprietary Limited ABN 31 008 428 322, AFSL 234654 (N.M. Super) and their representatives may receive in relation to products and services provided.

North and MyNorth are trademarks registered to NMMT.

All information on this website is subject to change without notice.

This article is for professional adviser use only and mustn’t be distributed to or made available to retail clients. It contains general advice only and doesn’t consider a person’s personal goals, financial situation or needs. A person should consider whether this information is appropriate for them before making any decisions. It’s important a person considers their circumstances and reads the relevant product disclosure statement and/or investor directed portfolio services guide, available from NMMT at northonline.com.au or by calling 1800 667 841, before deciding what’s right for them. You can read the NMMT Financial Services Guide online for more information, including the fees and benefits that AMP companies and their representatives may receive in relation to products and services provided. You can also ask us for a hard copy.