In today’s busy world, time is critical. So whether you’re completing a client review, performing a switch or preparing an ROA, you need your platform to work as efficiently as possible to free up your time to add value with your clients.

Did you know you can assign a risk profile to your client account to make sure their investment mix is within risk tolerance ranges…all on the North platform?

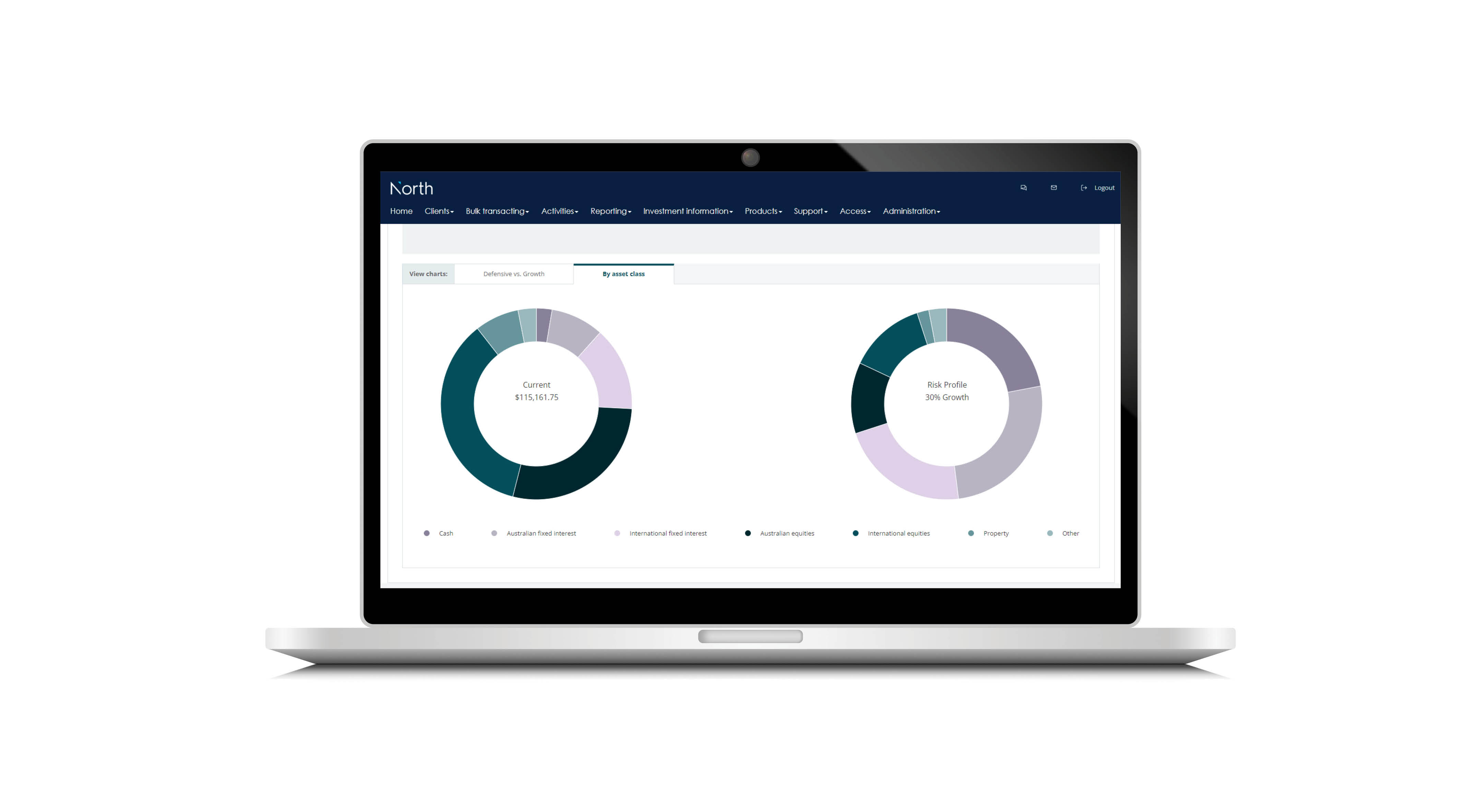

So now it’s easy to maintain the right investment mix without fiddling around with external tools.

- Get the most accurate view of your client portfolio to check it’s in line with target allocations.

- Receive an optional quick alert and take action when an allocation deviates from acceptable range.

- Help clients better understand risk profiles by using the charts in discussions.

Many advisers are already using risk profiles on North to save time and enhance their client service. So don’t get left behind…start using risk profiles today.

Getting started

If your Licensee has added risk profiles, you'll find them when reviewing your client’s account summary or performing an investment switch.

Otherwise you can easily add them yourself through the quick setup process on North Online.

How it works – hint it’s simple and intuitive

You can easily check in real time the portfolio you’re recommending for your client is within their risk tolerance ranges.

1. ADDING AND UPDATING CLIENT RISK PROFILES

Once you’re all set up, you can easily add or update your client’s risk profile when their circumstances change – either from the Account Summary page or while you’re performing a switch.

2. CHECK AGAINST TARGET

You can see how your client’s investment portfolio aligns to their target allocations. Warning messages will guide you when the asset allocation is outside the acceptable range for the risk profile.

3. GET ALERTS

You can also opt in to event alerts at a frequency of your choice so you can easily take action if there are any variances between your client’s risk profile and their asset allocation.

4. PREPARE ROA

When you’re preparing ROAs, your input document will show the variance between your proposed asset allocation and the risk profile, helping you meet your disclosure requirements.

Looking to start using risk profiles on North? Chat to your BDM today.

Want more information?

Econosights - positive supply shocks

02 May 2024 | Blog Post pandemic, the supply of labour has increased in many major economies, including the US and Australia, through elevated immigration and a lift in the participation rate to a record high. Read more

Retail spending declines in March

30 April 2024 | Blog Retail spending declines in February, reversing Swift Lift in Feb and indicating that consumers still under pressure. Not consistent with an economy that needs higher interest rates. Read more

Oliver's insights - the art of happiness

29 April 2024 | Blog This article looks at happiness and whether economics is failing us with its focus on GDP and consumption. Read moreWhat you need to know

The information on this page has been provided by NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT) for professional advisers only, regarding enhancements on our North Platform. North and MyNorth are trademarks registered to NMMT.